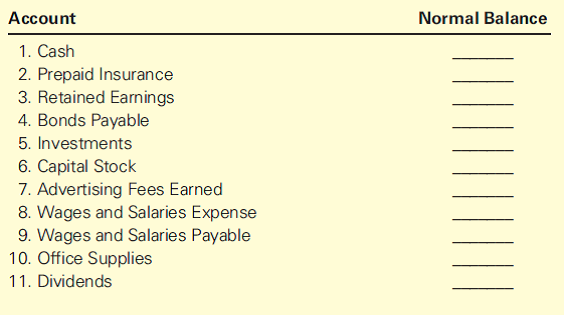

As you will see from the illustration above, there are cases when the debit side increases and cases where the credit side increases. The rest of the accounts to the right of the Beginning Equity amount, are either going to increase or decrease owner’s equity. This means that the new accounting year starts with no revenue amounts, no expense amounts, and no amount in the drawing account. Accounts Receivable is an asset account and is increased with a debit; Service Revenues is increased with a credit. In accounting, the normal balance of an account is the preferred type of net balance that it should have.

Liabilities and Equity Accounts with Credit Balances

- Job costing is a cost accounting method in which costs are accumulated for individual orders (activities).

- This shapes the financial story of both personal and business finances.

- A contra revenue account that reports the discounts allowed by the seller if the customer pays the amount owed within a specified time period.

- The normal balance of all asset and expense accounts is debit where as the normal balance of all liabilities, and equity (or capital) accounts is credit.

- The following example may be helpful to understand the practical application of rules of debit and credit explained in above discussion.

Since the accounting cycle starts with a journal comprising of debit and credit entries, the use of a double entry accounting is not possible without strict adherence to these rules. The rules of debit and credit are the heart of accounting and their understanding is extremely important for individuals responsible for handling the accounting system of a business entity. Expense accounts, like hungry caterpillars, are always consuming resources, craving debits to grow.

Understanding the Basics of Debits and Credits

They follow the Generally Accepted Accounting Principles (GAAP), making tasks simpler and more reliable. The Small Business Administration (SBA) highlights the importance of checking account classifications. This helps find and fix any mistakes that don’t match the standard accounting rules. It helps avoid common errors that lead to 60% of accounting mistakes, as found by a study from Indiana University. Entities should also aim to refill their fund balances in one to three years. This considers things like the economy, recovering from big events, and planning finances.

Double Entry Bookkeeping

Meanwhile, expense accounts reflect costs in making revenue, typically having a debit balance. Recording an expense as a debit shows its reducing effect on equity. It was started by Luca Pacioli, a Renaissance mathematician, over 500 years ago.

The net realizable value of the accounts receivable is the accounts receivable minus the allowance for doubtful accounts. Understanding the normal balance of an account is essential for maintaining accurate financial records and preparing financial statements. It helps identify errors in the accounting system normal balance accounting definition and ensures that financial transactions are recorded correctly. Knowing the normal balance of an account helps you understand how to increase and decrease accounts. Next, we’ll move on to adjusting these accounts with journal entries. Normal balance shows how transactions flow through different accounts.

Normal Balance of Accounts Explained: Ensuring Financial Stability

For example, asset accounts and expense accounts normally have debit balances. Revenues, liabilities, and stockholders’ equity accounts normally have credit balances. Expense accounts are used to record the consumption of assets or services that are necessary to generate revenue. These accounts typically have a debit balance because expenses decrease equity. When a company incurs an expense, the relevant expense account is debited, reflecting the reduction in the company’s assets or the creation of a liability.

Revenue is the income that a company earns from its business activities, typically from the sale of goods and services to customers. When a company makes a sale, it credits the Revenue account. So, if a company takes out a loan, it would credit the Loan Payable account. Ed’s inventory would have an ending debit balance of $40,000 and a debit balance in cash of $15,000. These are both asset accounts.He would debit inventory for $10,000 due to the new inventory and credit cash for $10,000 due to the cost.

Assume he bought the computers with cash and his starting cash account had $25,000 in it. Each account type (Assets, Liabilities, Equity, Revenue, Expenses) is assigned a Normal Balance based on where it falls in the Accounting Equation. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

Deixe um comentário